Moneytree

Forty years of ups and downs, crashes and black Mondays, bubbles and busts, fun and frolic, life long friends and little financial independence.

I volunteered to write this little history of our club. When we first formed in 1984, I am sure that none of us thought we might still be meeting and investing 40 years later. We are still meeting and have actually discussed disbanding but most of us – we are fewer in number these days – believed that we would probably still meet even if the value of the club went to zero. Because, you see, this club is more than a collection of stocks to us.

– Paul J. Weisgerber, Treasurer, Moneytree Investment Club (2024)

March 1984 –

Forty years later it is hard to remember what was going on in 1984. Ronald Reagan was re-elected at the end of the year beating out Walter Mondale and that is the only event I can remember. (Wikipedia tells me that Indira Gandhi was assassinated that year by her guards.) I and the other half dozen or so other engineers at what was then Cincinnati Milacron thought it would be interesting, educational and fun to start a stock club to jointly and directly invest in securities. We admitted to ourselves that we knew little about that activity but we were all engineers and nerds so we could easily learn.

The tools provided by the National Association of Investment Clubs appealed to our natural inclination to quantify and focus on positive and negative aspects of things, in this case individual publicly traded companies. Value Line provided the extensive collection of detail facts that engineering minds needed to be convinced to spend twenty bucks a month. We were and still are very conservative investors. Did we get rich overnight or even the next night? The answer to that depends entirely on how one defines rich.

Early Investing –

As we sorted ourselves out into various leadership roles and met to write articles of partnership and studied various companies, we also put $20 into the monthly pot to build a purse to purchase securities. Many of us, me included, made the donation in cash. (Rather than explain to my wife about spending twenty bucks on what she thought was a risky activity, I could call it lunch.) I still have some old receipts in Lyle’s hand from those meetings.

Our first Treasurer, Lyle, opened a checking account at a local bank. Every week after our meeting he would go to this bank, selected because of convenience and the fact of early adoption of a drive through window, he filled out a deposit slip by hand and deposited the money in Moneytree’s account. Like many engineers or men for that matter his handwriting was atrocious. The fact that he had to write “20.00” ten times on the deposit slip seemed to tire his hand. As the slip was written out vertically he would drag his pen down the page. Many of the “20” notations look like 30.

We did not buy any securities this first year of organization. When I was elected treasurer in 1985, I closed that account and moved the funds to the credit union (Milacru) located on the property of Cincinnati Milacron. I chose to walk across the parking lot after our meetings and deposit the money there. After Cincinnati Milacron shut down business in Oakley, their main campus, Milacru moved to a location near the Afton plant and changed their name to Ohio Valley Federal Credit Union. We still have our checking account there but I have digressed a bit. Lyle’s handwriting was crappy and some poor clerk at the bank recorded our account deposit as $250 in one month instead of $200. We started originally with ten members. (I have often wondered if that person is still in banking. The bank itself is no more.)

Our first profit from investing was due to Lyle’s crappy handwriting. In case you are wondering, banks do not always believe you if you tell them they gave you too much money. Especially if it is many months after the error and the deposit was in cash.

Our first real investment was another fine local company, Proctor and Gamble. P&G at the time allowed direct purchase of their stock. After the initial purchase of ten shares we opted to reinvest the dividends. P&G did that for us internally and sent an account statement much like a bank does. I remember all of this because initially the Moneytree Treasurer kept track of all this activity.

Officers and Duties –

The current President presides at the meeting and calls it to order. In his absence the Vice President performs this duty. The offices of Pres., V.P., and Secy. rotate through the membership and our elections are held in December. These are typical officers of any organization additionally we have several other officers and duties that makes the club ours.

The Treasurer has the duty of keeping the clubs accounts and initially the job of dealing with the broker and tracking portfolio stock performance was given to the Treasurer. Early on we separated the treasurer’s duties of keeping track of the membership accounts, filing tax documents, closing the books for the current year, opening the books for a new year and assessing and reporting monthly on the financial status of all cash and securities. At first this was all done by hand but in 1985 I began to use an early version of Visicalc spreadsheet program on a Commodore 64 computer. Later this was converted to Lotus 123 on my IBM PC at work. These days it is an Excel spreadsheet style report. By adding spreadsheet sophistication to our records it became easy to collect and gather and report on other statistics for individual securities.

The treasurer became overwhelmed with doing all of this reporting much of which could not be done before the market close on the Friday previous to the Monday evening meeting. Soccer, baseball, volleyball and basketball all got in the way depending upon the time of year it was. We created the office of Portfolio Manager. Management of the portfolio; buying, selling, tracking various statistics and general management of the broker account was split off early. The Secretary’s minutes, the Treasurer’s report and the Portfolio Manager’s (PM) report begin each meeting. The PM also reports on the market response of the portfolio securities the day of the meeting. The treasurer reports all the cash accounts and the value of each partnership share at the time of the meeting. The secretary reminds us of what we did the previous month besides eat and drink.

The I-Told-You-So report developed out of a bit of hindsight sarcasm. One of the members began tracking stocks that we had sold. It seemed to him that many of the stocks that Moneytree previously divested would often increase in price during the next few months. This report tells us how little prescience is available to us as a club. One of our membership that is particularly interested in this aspect reports on those at the beginning of each meeting. (One of several mottoes adopted along the forty year journey is: Buy high, Sell low) After Steve passes out his report we order another a pitcher of beer so there is some left to cry into.

Sargent at Arms has only one duty and that is to provide a organized list of review stocks. The list is sorted generally on when a Value Line is published for that company. Some adjustments are made when too many securities have VL reports in the same month. VL is not the only source of information but early on these were easily available at the library and provided a substantial collection of statistical information. Today reading the VL comment paragraphs and counting “augurs well” is a tradition. Within our club various members are assigned a security to track and report to the membership on that company.

Stock statistical tracking occurs as a part of the portfolio manager’s report. How the company is doing as a whole; sales, earnings, view from other sources, timeliness and all those other nuances are reported on quarterly for all of the securities in the portfolio by the member assigned an individual security.

Records –

Records for each office are kept by the particular officers. There is some longevity to the Treasurer and Portfolio Manager positions so there is some stability to those records. They are electronic and the records are passed to an alternate member at the end of each year.

Club Membership –

Our membership is open to all but we do not actively seek new members. We had ten folks who were interested at being financially well-off at the first meeting. They were all engineers and through brilliant analysis often unattributed to engineering folks, we recognized that it might be smart to have others of other disciplines participate. We sought out new members who were not engineering oriented.

At its largest the Moneytree was composed of nineteen members. At its height we had engineers, doctors, accountants, sales folks and managers. It made for a good mix of opinions about any particular company.

Many of members were often absent when it was their turn to present the company that they were assigned to follow.

Parties and Celebrations –

These days our meetings are held on the fourth Monday of the month. The agenda of each meeting is the same but earlier in our existence we had a special meeting at Christmas time. Our Christmas meeting was mostly social with wives invited but we did have a short meeting to either congratulate ourselves or guffaw at our successes and failures.’

Two of our members were also members of a local country club. Christmas meetings were held at the country club so a great time was “had by all.” One of these special gatherings occurred just after the value of our portfolio crept over $100k. As a special treat we had $100,000 candy bars and cigars.

To accommodate the interests of a few members, the November meeting theme in the past was “Penny stock night”. Many of those buy decisions have interesting stories associated with them. U. S. Wind Farm, Inc. is the best story from this era. If you are interested my blog has more detail. (https://adjunctwizard.com/a-mystery/) Chasing down information about stocks, companies and legal entanglements is so much easier in the land of the internet. We thank the former vice president every day for inventing it and bringing global warming to our attention. It is too bad this was not so in the 1990s. This was our chance to cash in on the newly developing alternative power generation industry. We did not but it is a good story none the less and the final link in the company chain is called “ARS”. Perhaps this is a clue.

COVID-19 and Zoom –

Through the pandemic pandemonium we kept up meetings via Zoom.

These Days –

We meet in the back room of a local pub centrally located to all of us. A few years ago one of our members, not visible it the adjacent poor selfie, proposed that we have a dinner meeting and since that time we pass around a sheet of paper and a menu before the meeting begins. This particular pub has a Monday night spaghetti special which is quite good. Usually by the time we are through with our standard reports the food has arrived so we pause for a few minutes and chew, catch-up and act like the young men we once were.

Each meeting’s agenda is the same.

- Open the meeting

- Minutes of previous meeting (vote to adopt)

- Treasurer’s report (vote to adopt)

- Portfolio Manager’s Report (vote to adopt)

- Stop to eat for a few minutes

- Members report on current securities for the month (discussion)

- New stocks to consider by the membership (discussion)

- Any other business

- Adjourn

- Sometimes darts – we are meeting in a pub near the dart boards. Most often just BS as folks drift out the door.

We have been friends and associates for forty years. None of us realized that we had been meeting for this length of time until I received the letter from Better Investing and read it out loud at our last meeting reminding us that we were all old. (smiley face here) We all agree it has been a great experience. It is educational in many ways. We have developed our own techniques in addition to the BI tools. We still entertain the idea of hitting the lotto with some penny stock. We missed Amazon. (sad smiley face) But the club has become self-sustaining. There is more than enough dividend income to grow slowly and feed us once a month.

We meet not to gain richness in the monetary sense. It is richness in life. This is a better definition of richness. Friendship, camaraderie and social interaction is a big draw. We are fewer now. We have just eight members. If someone is not at the meeting they are typically in Florida or fly fishing in Idaho.

Current Portfolio –

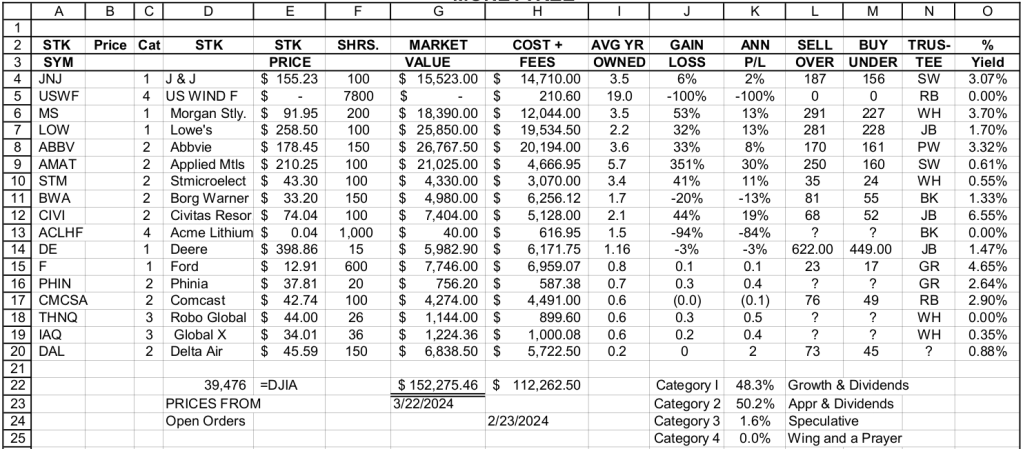

A snapshot of the Portfolio Manager’s report: (Notice we still own U S Wind Farm – we offered all 10,000 shares @ .01/share for sale but someone only bought 2200. Go figure.)

Categories were adopted over time and annualized profit/loss provide a guide to the quality of the security. We actively trade stocks after much discussion (and beer.)